With time ticking on the Solar Investment Tax Credit (ITC), is now the best time to install solar?

Determining the best time to install a solar system can be a challenge for many homeowners. In fact, the cost of solar has dropped substantially over the last several years; prompting homeowners to consider waiting for the cost of solar to decrease even further, in an effort to get it a bit cheaper. However, major incentives like the 30% federal tax credit are scheduled to decline at the start of next year. This step-down means that the net cost of solar could actually increase over the next few years.

This article explains how the ITC works, offers suggestions on the best time to go solar, and provides homeowners with a free tool to calculate the amount of credit they can expect to receive, including how it can be applied over multiple tax years.

What is the Solar Investment Tax Credit?

The Solar Investment Tax Credit (ITC) is currently a 30 percent federal tax credit designed to be applied to the personal income taxes of homeowners who purchase and install solar systems.

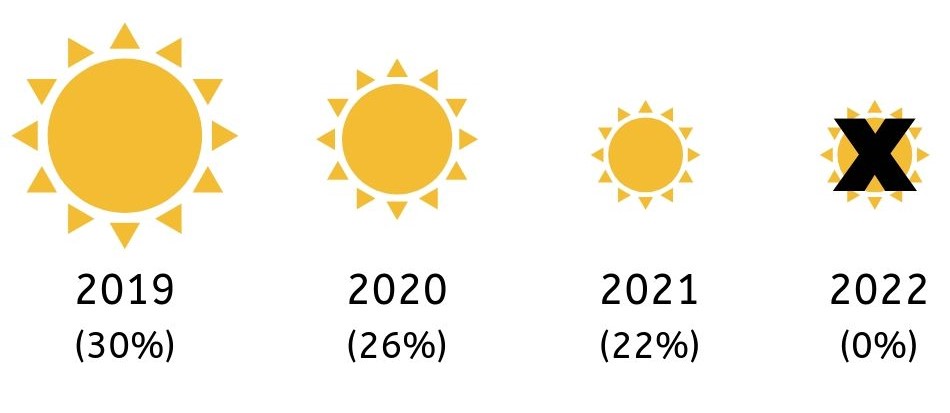

In 2020, that amount decreases to 26 percent; in 2021, it decreases further to 22 percent. After 2021, the incentive for residential installations drops to zero and to 10% for commercial projects.

ITC Residential Step-down (2019-2022)

Is now a good time to go solar?

Based on data from the Lawrence Berkeley Labs, SolarReviews.com estimates the average 6kW solar system costs approximately $19,000. Therefore, the average eligible savings from the ITC in 2019 is $5,700.

According to SEIA, solar is as cheap as it has ever been. In fact, the cost to install solar has dropped by more than 70 percent over the last decade. Our analysis at Solar-Estimate.org suggests that the best time for a homeowner to go solar is in 2019, with the net price per watt ranging from $2.21 to $2.45.

However, as we explored in a recent article explaining the solar ITC, because the decrease will be a gradual one, there may not be a significant difference between the net price of solar in 2019 and 2020. If going solar in 2019 is not an option for you, it will still be possible to get a good net price in 2020.

How do I calculate the ITC?

At face value, calculating the Solar Investment Tax Credit for a residential solar project in 2019 is straightforward – simply multiply the total system cost by 30 percent.

However, complications can arise for taxpayers if the tax credit exceeds the amount of federal taxes owed. Given that the ITC is nonrefundable, the tax credit’s value would be spread out over several years in this instance.

To help homeowners navigate this confusion, Solar-Estimate.org has created a Solar Tax Credit Calculator that is available to the public at no cost. The calculator uses tax brackets and standard deductions based on the 2019 tax year to estimate a homeowner’s credit amount and credit schedule

Our conclusion:

The best time to go solar is in 2019 — and for homeowners who act quickly, there may still time to take advantage of the 30 percent credit. With that said, if a solar system is financially not in the cards right now, homeowners needn’t worry. With generous tax incentives and the increased efficiency of solar panels, 2020 will also be a good year to go solar

Author:

Kim Rapkins – Solar-Estimate.org

Alternative Energy HQ solar power for homes, wind energy, and bio fuel issues

Alternative Energy HQ solar power for homes, wind energy, and bio fuel issues

One comment

Pingback: The Best Time to Go Solar is Now