March 21, 2012—The U.S. Department of Commerce has reached a preliminary decision regarding anti-dumping (AD) and countervailing duty (CVD) petitions against Chinese solar makers. Punitive duties on imports to the U.S. are set below 5%, lower than generally expected – Suntech will face tariffs of 2.9%, Changzhou Trina Solar Energy 4.73%, and all other Chinese manufacturers 3.59%. The U.S.’s anti-dumping ruling will be announced on May 17, and EnergyTrend, green energy research division of TrendForce, believes the combined AD and CVD tariffs may be lower than 20% – currently it seems like all the commotion surrounding the lawsuits was unwarranted.

Source: EnergyTrend

EnergyTrend analyzes the preliminary ruling from three perspectives: the status of China’s solar industry, the relationship between Chinese and Taiwanese vendors, and how this will affect the anti-dumping ruling.

1) Status of China’s Solar Industry

According to EnergyTrend, China’s second and third-tier solar panel manufacturers are not adept at taking orders themselves – the majority rely on orders outsourced by major makers. As a precaution against the U.S. AD and CVD lawsuits, Chinese manufacturers began moving production to Taiwan at the end of 2011, negatively affecting China’s second and third-tier makers. As the anti-dumping decision will not be reached until mid-May and the market currently remains in a state of oversupply, EnergyTrend believes major manufacturers will not significantly increase order volume to second and third-tier makers before May, which means the smaller makers will continue to suffer in the short term.

2) China-Taiwan Cooperation

As demand from the North American market is currently strong, it is unlikely Chinese manufacturers will give up on such a lucrative opportunity. According to EnergyTrend research, prior to the the AD ruling in May, Chinese makers will continue to maintain the same amount of outsourcing to Taiwanese manufacturers. Furthermore, the Taiwanese government recently decided to allow Chinese vendors to invest in the Taiwanese solar industry, a move that EnergyTrend believes will deepen cooperative ties between China and Taiwan.

3) Influence on the Anti-dumping Ruling

As the U.S. government’s punitive tariffs are largely symbolic so far, EnergyTrend believes there is a chance China will also be let off easily in May’s anti-dumping decision, with combined duties amounting to less than 20%.

As punitive tarrifs are set below 5%, and manufacturers’ production cost is already close to breaking even, EnergyTrend believes industry vendors will raise their selling prices to deal with the changes. From the cost perspective, according to EnergyTrend calculations, total cost for outsourced production is 10-20% more than China vendors’ own manufacturing cost. If the combined AD and CVD tarrifs are less than 20%, EnergyTrend believes Chinese manufacturers will maintain the current level of outsourcing to Taiwanese makers. Taiwanese manufacturers’ orders will continue to increase after May.

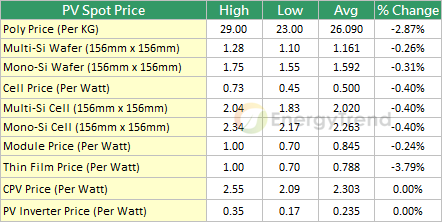

As for spot price, according to EnergyTrend research, as traders and some makers continued to clear excess polysilicon inventory this week and demand is still weak, spot price continues to fall. Lowest traded price this week was US$23/kg, while average price fell by 2.87% to US$26.09. In terms of silicon wafers, as vendors and buyers were not seeing eye-to-eye this week, price negotiations have arrived at an impasse. Average multi-Si wafer price fell only slightly, by 0.26% to US$1.161/piece. Average mono-Si wafer price fell by 0.31% to US1.592/piece. As for solar cells and modules, this week’s average solar cell price was US$0.5/Watt, representing a 0.4% decrease – mono wafer and high-efficiency product price continued to fall. As solar module makers are facing the pressure of losses for the first half of the year, current price quotes are nearing manufacturers’ minimums and it is unlikely there will be any significant price adjustments in the near future. Thus, this week’s average solar module price fell only slightly, by 0.24% to US$0.845/Watt.

Alternative Energy HQ solar power for homes, wind energy, and bio fuel issues

Alternative Energy HQ solar power for homes, wind energy, and bio fuel issues