Recent elections in Europe ushered in uncertainty for the solar market, and the subsidy policies to take effect in 2012 also rendered players conservative. According to EnergyTrend, the solar research division of TrendForce, orders for solar modules will continue to pour in till mid-May, while orders for solar cells will persist till early June. When asked about the orders in 2H’June, related manufacturers stated that given the cutthroat competition, companies still walk on thin ice, because any market noise could cost them orders from clients. Before the murky outlook turns clear, conservatism will keep on dominating the downstream solar industry.

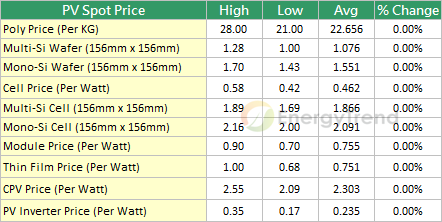

Source: EnergyTrend

Moreover, related manufacturers pointed out that so far the orders in 2Q12 will pour in well into early June, but orders in 3Q12 and 4Q12 will start emerging at InterSolar Europe 2012, which is set to commence on June 13-15, 2012. However, spurred by the subsidy changes, German and Italian solar markets see strong demand in 1H12. Related companies indicated that Germany’s solar demand in 1H12 is expected to amount to 3GW. Nonetheless, due to the fact that the booming growth in 1H12 is attributed to the large subsidy cuts to become effective in 2H12, countries which have seen steep upswings in installed solar capacities in 1H12 are likely to undergo setbacks in 2H12. On the other hand, rumor has it that solar prices will change soon. Yet, according to TrendForce’s survey, the current spot prices are already below the manufacturing costs. Aside from a number of manufacturers offering low prices for certain clients, the current spot prices will most likely stay flat.

In terms of utilization rate, according to TrendForce, currently major solar makers are at full capacity. Chinese major solar module makers Trina Solar, JA Solar, and Suntech Power’s are all packed to capacity, while Taiwanese major solar cell makers’ utilization rates are above 80%, which shows the solar companies are striving to catch up with the 2Q12 orders. However, certain manufacturers are still concerned about the outlook after June. Manufacturers stated that most orders in 1H12 have been placed, but major makers’ utilization rates still remain high. Given the post-June uncertainty and the high utilization rates persisting, spot prices may plunge further.

As for this week’s spot prices, on account of the fact that the spot prices have already fallen below the costs, manufacturers were unable to further cut prices, therefore, the spot prices stayed flat. As for polysilicon, a price of $20.5/kg was made from the demand end, but it fell through. As for silicon wafers and solar modules, the prices stayed flat. High-efficiency products’ prices were relatively stable despite the downtrend. Manufacturers stated that although the market is presently in oversupply, excluding the old capacities, high-efficiency products are still on tight supply. Thus, the price trends of high-efficiency products and regular products are expected to differ vastly in the short run.

Alternative Energy HQ solar power for homes, wind energy, and bio fuel issues

Alternative Energy HQ solar power for homes, wind energy, and bio fuel issues