GROUPS: SOUTHERN COMPANY DOES NOT HAVE REAL “SKIN IN THE GAME” IF VOGTLE REACTOR LOAN GUARANTEE DEFAULTS

Industry Group Spreading Falsehoods About Viability of Controversial Nuclear Project

WASHINGTON, D.C. – February 23, 2012 – With the U.S. Department of Energy (DOE) believed to be just days away from awarding a $8.33 billion taxpayer-backed loan guarantee to Southern Company/Georgia Power and their utility partners for the proposed Vogtle reactors in Georgia, concerned groups are warning that several falsehoods are being spread about the risks faced by U.S. taxpayers.

In particular, the Southern Alliance for Clean Energy and NC WARN pointed to a news release circulated on February 16, 2012 by the Nuclear Energy Institute, the trade organization for the nuclear industry. (See http://www.nei.org/newsandevents/newsreleases/doe-loan-guarantee-for-plant-vogtle-expansion-on-sound-financial-footing/.)

Among the falsehoods contained in the release are the following:

MYTH: Southern/Georgia Power is bearing a major financial risk along with U.S. taxpayers. As the NEI release states: “Georgia Power has considerable financial skin in the game with more than $4 billion already invested …”

TRUTH: Southern/Georgia Power is using ratepayers to cancel out its risks. In fact, Southern Company/Georgia Power are benefitting from a “construction work in progress” (CWIP) arrangement under which ratepayers are footing the bill in advance for much of the risk that otherwise would be borne by the utility. The risks of plant cancellation, cost overruns and the emergence of cheaper technologies have all been shifted from the company to its customers by recent changes in Georgia law. This is the crucial difference between the Vogtle reactor projects and the failed Calvert Cliffs project in Maryland and the South Texas Project, where utilities could not immunize themselves against risk by tapping up front the pocketbooks of ratepayers. Furthermore, the amount of money invested by Georgia Power under this no-risk legal framework does not approach $4 billion. According to filings with Georgia regulators, the company has not invested even half of that amount.

MYTH: The Vogtle project is on sound footing already. As the NEI release states: “In addition to the extensive due diligence activities conducted by the DOE loan guarantee program office, the Vogtle project is subject to rigorous federal and state oversight, including ongoing detailed project reviews being performed for the Georgia Public Service Commission.”

TRUTH: The Vogtle reactors are already running behind schedule and heading into cost overruns. Last week, concerned organizations warned that Southern Company is deliberately keeping U.S. taxpayers in the dark by covering up the details of 12 sizeable construction “change order” requests that are expected to add major delays and cost overruns to the controversial reactor project. The secret cost overruns are discussed in a censored report from late 2011 by the independent Vogtle construction monitor, Dr. William Jacobs, who is a veteran nuclear industry engineer. Much of Jacob’s testimony was redacted by the utility in the attempt to keep the troubling information from the public, including the U.S. taxpayers who will be left holding the bag if Southern Company defaults on the federal loan guarantee. The groups are calling on the DOE to insist on full disclosure of the Vogtle delays and cost overruns before the federal agency moves ahead with a massive $8.33 billion

taxpayer-backed federal loan guarantee that would be 15 times what was lost in the Solyndra debacle. (For more details, see http://www.cleanenergy.org/index.php?/Press-Update.html?form_id=8&item_id=278.)

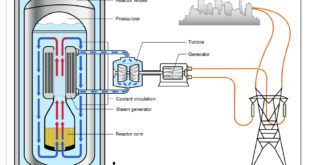

MYTH: Unlike Solyndra, the Vogtle reactor risks are low because it is based on proven technology. As NEI states: “There is no factual basis for the nonsensical claims these groups are making about the loan guarantee for the new advanced-design reactors that will be constructed at Plant Vogtle. Solyndra was a start-up manufacturing company competing in the global solar panel technology market. It had no assets, was working with an unproven technology with no customer base or steady revenue stream and obviously no profits.”

TRUTH: The AP1000 reactor is an entirely new and unproven technology. In addition to substantial legal and regulatory challenges, the AP1000 reactor faces the near-certainty of needing post-Fukushima changes to major components and systems, which would further delay reactor construction, increase costs, and boost the risk of default at the expense of U.S. taxpayers. There is no basis in previous experience to suggest that the AP1000 can come online on time or at cost; in fact, no AP1000 has yet to be completed or operated anywhere in the world. And Vogtle does have a history that should trouble taxpayers worried about assuming responsibility for the massive loan guarantee: The original two reactors at the Georgia site took almost 15 years to build, came in 1,200 percent over budget and resulted in the largest rate hike at the time in Georgia.

Alternative Energy HQ solar power for homes, wind energy, and bio fuel issues

Alternative Energy HQ solar power for homes, wind energy, and bio fuel issues